In today's "The Gartman Letter" Dennis points out what will happen if the "Bush Tax Cuts" expire:

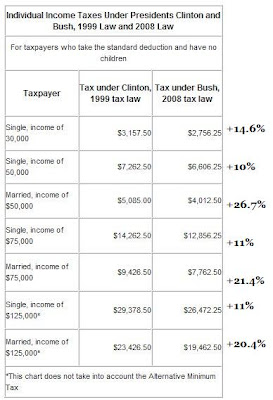

1. All income tax rates will go higher with the bottom rate moving up from 10% to 15% while the top rate shall go up from 35% to 39.6% (see chart above comparing 1999 and 2008 tax rates).

2. The tax credit for children will drop from $1000/child to $500.

3. The standard deduction for married couples will be cut.

4. Capital gains taxes will go up from 15% to 20%.

5. Dividends, which now are taxed at a lower rate than earned income will rise to that same level.

6. The one year “exemption” in estate taxes ends but with a $1 million exemption, and the tax rate goes to 55%.

The chart below is from The Tax Foundation and compares annual individual income taxes paid before and after the "Bush tax cuts" by various income groups:

And in fact, the group in the chart above that would experience the largest percentage increase in taxes would be the married taxpayers with $50,000 of household income (clearly middle class by most definitions) - they would pay 26.7% more in taxes if the Bush tax rates expire. By contrast, "rich" single taxpayers with income of $125,000 would pay only 10% more in taxes. In other words, some middle-class taxpayers received twice the tax cut on a percentage basis as some of "the rich" under the Bush tax rates, and that group would suffer the most with higher taxes if the current federal income tax rates expire.